Professionals in the wedding business face unique struggles. You work hard to deliver experiences your clients have been dreaming of their entire lives. You navigate multiple issues and emotional stakeholders, all while trying to run a business.

And when the theme of the day is love and romance, the issue of money can seem out of place — especially when it comes to collecting payments as a wedding planner.

There are some interesting problems that come along with long lead times and high emotions. Especially when you’re talking about payments. Whether you’re a wedding planner, DJ or florist, here are just a few of the quirky payment issues that wedding vendors like you deal with all the time.

Email and Text Templates to Ask for Missing Payments

DownloadWedding Planner Payment Problems

Below are four common problems that wedding planners face when running their businesses.

1. Deciding on Deposits

Most people plan their weddings several months in advance. That means vendors usually invest resources on planning or production before delivery. Whether you’re a baker investing time in cake design, tastings or special supplies; or a wedding coordinator making calls, scouting venues, and hiring temporary staff — no one wants to work for free. At the same time, you want to make it easy for clients to do business with you.

So how do you cover your expenses without discouraging potential customers from signing a contract with you?

Many vendors require a deposit when signing a contract. This ranges anywhere from 10-50% of the overall quote. The deposit goes toward the final price paid for the service. While this can help with the initial costs you incur, you typically have to refund the deposit if the client chooses to cancel.

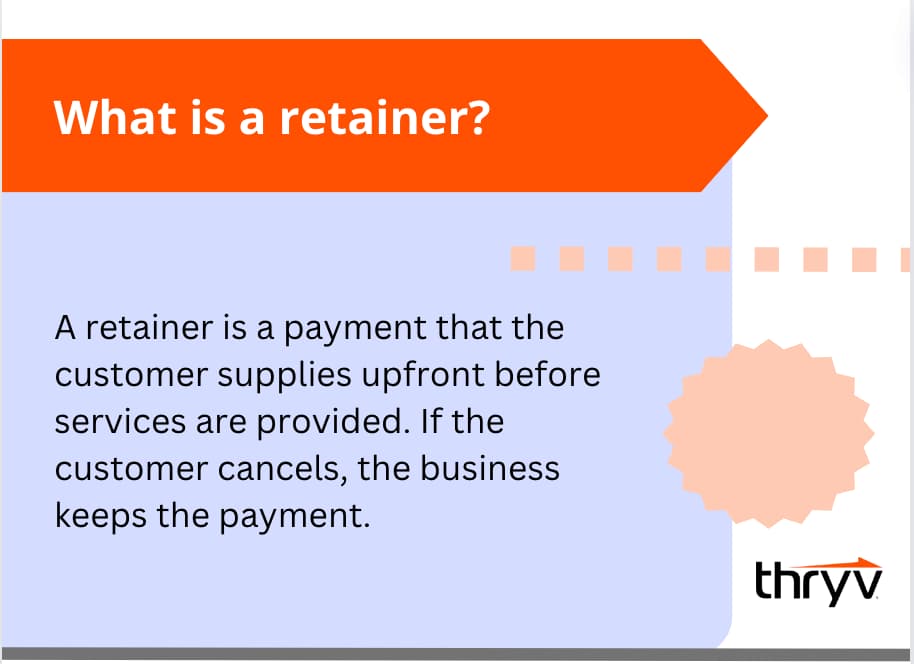

Retainers vs Deposits

Another option is a retainer. The client pays the retainer up front and you keep it if the client cancels. One photographer on BridalTweet requires a signed contract and 25% of the photography package as a retainer to reserve the date.

The retainer still goes toward the final price of the service, but it safeguards you from losing too much money by not being available for another client if the original one cancels. Depending on the season, you may want to increase or decrease this retainer.

An added benefit to a retainer is that your client is more financially invested. This makes them less likely to choose another vendor on a whim.

A note about retainers: Retainers are non-refundable as long as the client is the one who backs out. If you’re the one to cancel the contract, you must return it. And if your client sues you to get this retainer back, you could be stuck paying the legal fees too. Here’s the legal case of a photographer who had to do just that.

2. Everyone Wants to Pay

How many times has a parent or relative approached you to pay for part of your service as a gift to the couple? Weddings are wonderful because so many people want to contribute. But this can make it difficult to coordinate payments from different parties.

Always remember: While you may be getting input (and payments) from multiple parties, there should only be one person on your contract who is financially responsible for the final bill.

Another issue with multiple people contributing financially is when they use it as a delay tactic. Or, when they’re just trying to get you to work for free. “Oh, my mom is going to make that payment tomorrow, but I just need you to…” is a familiar phrase to many in the wedding biz.

To minimize issues like this, make it easy for anyone to give you money by accepting online payments. It’s a lot harder to come up with an excuse for why someone can’t pay you immediately. Nothing’s faster or more convenient than the option to pay online with a credit card. You’ll never hear excuses like, “The check’s in the mail” or “I couldn’t make it to the bank today” again.

Business software like Thryv can help you accept credit card payments online or with your phone, making it easier on both you and your client.

3. Increasing Demands & Budget

So much can happen as wedding planning progresses. That 2-tier cake may turn into five tiers, and those 100 wedding guests may increase to 250. With these growing demands, you’ll need to revise quotes and amend contracts.

Wedding Planner Payment Schedules

As you revise these documents, include a payment schedule so you’re both clear about how much money is due and when. The last thing you want is a client claiming sticker shock when it comes time to pay.

Most payment schedules include the following:

- Initial deposit or retainer – As we mentioned, these funds are usually due when your client signs the contract. Specify either a percentage of the total quote or a flat dollar amount.

- Payments along with the way – If you require partial payments along the way, specify exactly how much and when you expect them.

- Final payment for quoted services – Most vendors require full payment for the quoted services 10-14 days before the wedding. By this time, you should know the final number of guests, which services your client needs, venue logistics, and approximately how many hours you’ll work.

- Final invoice for wedding day charges – There are a number of costs you can’t really assess until the event is over, such as liquor costs from an open bar or rental items damaged upon return. Some vendors assess final charges at the end of the event and expect payment before they leave. Others send an invoice in the next few days. Be explicit about when you’ll assess these event day charges and when you’ll require payment.

Keep all the copies of your quotes and contracts in one place in case someone disputes the charges. You’ll have a comprehensive record of all the changes. Wedding clients are notorious for being scatterbrained during this stressful time, so you need to be on top of your game.

4. Buyer’s Remorse

Perspective is an interesting thing. During the wedding, you (and the client) may have thought your work was great. But it could quickly change to ‘The Worst Wedding Ever’ once the good cheer and celebrations are over.

And it might not even be your fault. Another vendor’s mistake could throw a negative shadow on the entire event. Suddenly your client thinks about all the little things that wouldn’t normally bother them. Another possibility is that they loved everything until the reality of paying for it dawned on them. They could also just be angling for a discount.

Wedding Planner Payment Terms

Whatever your client’s reason for the sudden change in perception, do your best to stick to the terms of your contract. A good contract includes a section on refundable and non-refundable fees. With that said, there are some clients who might warrant special consideration. Any discount you give to keep them happy could pay off in future referrals.

How Much is the Payment for a Wedding Planner

According to ZipRecruiter, the average wedding planner makes $22 an hour or roughly $46K each year. Note that most wedding planners will charge a percentage based on the services provided.

Managing Wedding Planning Payments

Being part of a couple’s special day can be rewarding both personally and financially. By setting clear expectations, maintaining good communication, and navigating these quirky payment issues well, you’ll set yourself up for success and future happy clients.