As government officials and experts discuss approaches for reopening our nation, people can’t help but have mixed feelings. Many are urging leaders to reopen and reinvigorate the economy, while others remain concerned for health and safety.

Regardless of your perspective on reopening, as the pandemic’s spread slows, business owners will soon be forced to consider how it’ll impact you and your team.

- Do you still have staff on payroll to support reopening?

- What about bills you’ve accrued? Are you up-to-date enough on those to reopen?

- What about demand? Will consumers want what you sell upon reopening?

- If you’re strapped for cash, can you meet demand if it increases sharply (at least in the short term)?

The 3 Simple Truths

It’s a lot to consider. That’s why we recently shared our perspective on the post-pandemic surge and what it means for small businesses.

Basically, business leaders and economists expect the economy to surge post-pandemic (at least in the short term) unlike it ever has. Unlike past recessions, consumers in quarantine due to COVID-19 are building up demand for many anticipated needs and wants. They’re being forced to put off current purchases to the future. Once state and local governments lift shelter in place orders, demand for products and services most small businesses provide should spike for at least a few weeks.

So, it’s important to analyze your current situation now, and begin planning for the post-pandemic surge as you can.

There’s plenty of advice going around about how to stay afloat during the crisis and how to reopen when ready. From our perspective, the smartest business owners will focus on the most critical facts of our current situation.

3 Simple Truths about the Post-Pandemic Surge:

- No one will buy from you if they don’t know you’re open or what you’re offering.

- No one will buy from you if they don’t know it’s simple and safe.

- People are more likely to buy from you if they know you help others.

Acting on the Advice: Planning for the Post-Pandemic Surge

There you have it.

But, so what? The next step is acting on it.

To help people know you’re open, feel safe buying from you, and support your business, there are a few things you can do.

- Communicate.

- Commit to safety.

- Contribute to your community.

Communicate

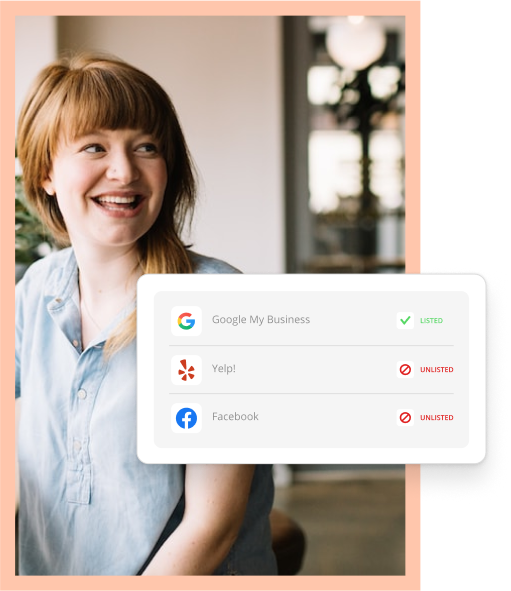

Consumers will be looking for businesses like yours on their mobile devices and across the internet. Your communications channels need to make it clear that you’re open (and in what capacity).

And, they need to convince consumers to purchase from you over the competition.

Email, text, carrier pigeon — whatever communications vehicles you already have in place to reach your audience — USE THEM!

Then, consider offers you can promote that are not only compelling, but creative.

Run a salon? You can’t see clients now, but your client list will be desperate to see you soon. Your offer could say, “Better hair days ahead! Post-pandemic Prep Offer – 50% off haircuts when we’re free!”

To seal the deal, tidy up your website. It should reflect what’s happening and how you’re reacting. Make it short, simple, and get straight to the point. Add an updated headline, a pop up…anything that screams:

- We are open.

- We have a great offer!

- And we help our community.

Commit to Safety

Even though most consumers will be rushing out to catch up on regular purchases like haircuts, retail shopping, dining out, even auto maintenance, many will still be concerned about how safe it all is.

Here are some ways to make working with you safer, so consumers feel confident choosing your business.

- Introduce contactless payment: No signature required, no card required, no nothing! Receive credit card numbers verbally or via mobile payment processing.

- Offer no-contact service: Make it clear you won’t so much as look at clients if you’re working in their home or around their house. Amp up your personal protective equipment including masks, booties and gloves. Alert clients when you arrive, so they can exit the home or remain isolated from your team.

- Schedule online: Allow mobile and online booking, so consumers can choose exactly how and when they interact with you. It doesn’t have to be for traditional appointment-based services, either. Schedule deliveries, curb-side pickup, even one-on-one social distancing consultations.

Contribute to the Community

Many consumers support small businesses, because they know just how important they are to the economy. So several people, maybe even some of your clients, have gone out of their way to make advance deposits, buy gift cards, even float small businesses extra cash during this crisis.

Now’s your turn to show them their help mattered.

Figure out how to invest back into the community that supports you, via:

- Donate your time: What’s your specialty? How can you give back to local consumers and other businesses?

- Donate money: If your small business is considered essential and you didn’t take a major hit to revenue during the crisis, consider donating monetarily to your favorite charity or other local businesses that weren’t as fortunate.

- Donate products: Have excess inventory laying around? Instead of letting it go to waste or collect dust, consider donating it to those who may need it sooner rather than later.